If you’ve opened your renewal notice lately and noticed a higher premium, you’re not alone. Auto insurance rates have been rising across the country — and not because of anything you did wrong. The reality is that several nationwide economic and industry factors are pushing prices upward for all insurance carriers.

At MVP Insurance, we believe in transparency and helping our clients understand why these changes are happening — and how we can help you navigate them.

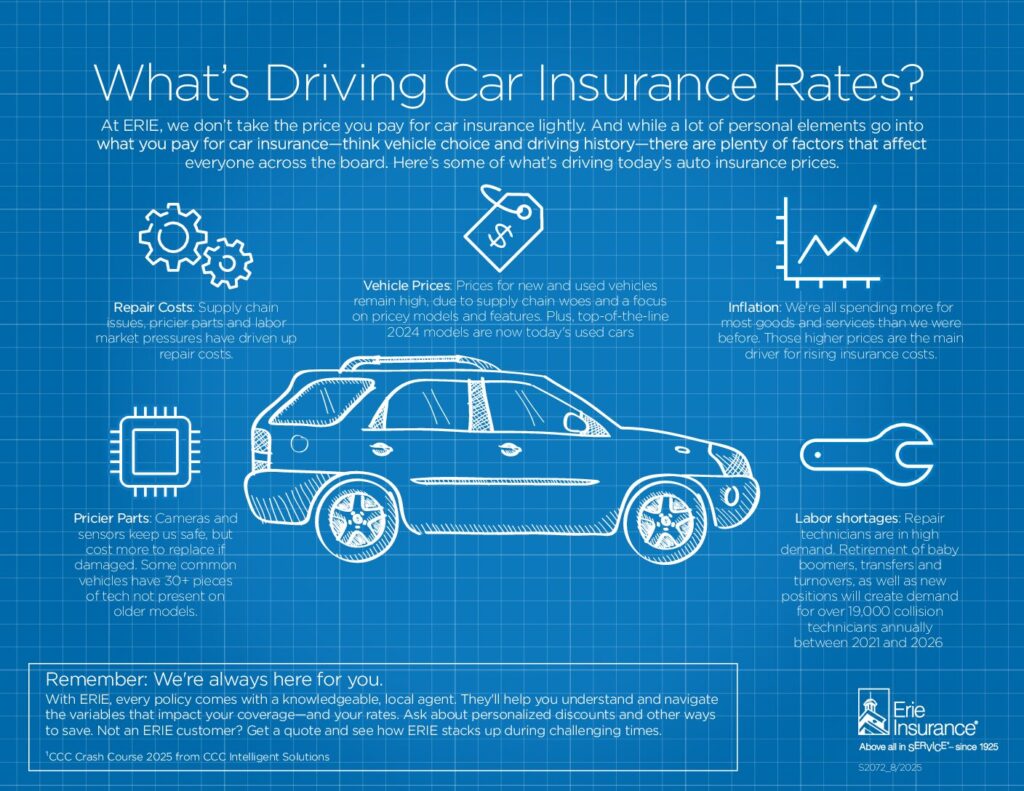

Here’s a breakdown of what’s driving today’s auto insurance rates:

🔧 1. Technology Makes Cars Safer — But More Expensive to Fix

Modern vehicles are loaded with cameras, sensors, and smart safety systems designed to prevent accidents. That’s great for protection — but the cost of repairing this tech has skyrocketed.

Even everyday vehicles now include 30+ advanced tech components that older cars never had. A simple fender-bender that used to require basic bodywork may now include recalibrating cameras or replacing radar sensors, increasing repair bills significantly.

🛠️ 2. Repair Costs Are Up

Supply chain delays, rising parts prices, and labor shortages have made auto repairs more expensive nationwide. Body shops are paying more for parts and skilled technicians, and those costs are reflected in repair estimates — which impacts insurance claim costs.

🚙 3. Vehicle Prices Continue to Climb

New and used cars remain more expensive than they were a few years ago. Limited inventory, supply chain challenges, and demand for premium features have driven prices higher — and now, those expensive 2024 vehicles are today’s used cars. The higher the value of the vehicle, the more it costs to insure.

👨🔧 4. Nationwide Shortage of Repair Technicians

The auto repair industry is facing a major talent shortage. Retirements, career shifts, and job turnover have led to an ongoing gap in skilled collision repair techs. Between 2021 and 2026, the industry will need over 19,000 collision technicians each year just to keep up.

When demand outweighs supply, labor costs rise — and so do repair costs.

💲 5. Inflation Impacts Almost Everything

We’re all paying more for everyday goods and services than we were just a few years ago. Insurance companies are not immune. The cost of claims (parts, labor, medical costs, litigation, etc.) has increased significantly, and that directly affects premiums.

✅ What You Can Control: Ways to Save

While the market is impacting everyone, there are ways to reduce your premium. At MVP Insurance, we can help you:

✔ Review your policy to ensure you’re not over-insured or under-insured

✔ Explore available discounts (multi-policy, safe driver, vehicle safety, etc.)

✔ Compare coverage options personalized to your needs

✔ Bundle home + auto for additional savings

🧡 MVP Insurance: Here to Help You Navigate It All

Insurance can feel overwhelming — but you don’t have to figure it out alone.

As your local, independent agency, our job is to:

• Explain what’s changing and why

• Provide options that fit your life and budget

• Advocate for you when you have questions or a claim

If you’re not currently an MVP client, we’d love to provide a hassle-free quote so you can see how we compare and where we can help you save.

📞 Call us or ✉️ request a quote on our website anytime — we’re here to make insurance easy to understand.